The 30 year fixed decreased to an average 3.41% with a 0.7 point (last year’s same date comparison was at 3.90%). The 15 year fixed rate mortgage dropped, as well, down to 2.64% with a 0.7 point (last year the 15 year FRM was at 3.13%).

Adjustable rate mortgages fluctuated as well, with the 5-year Treasury-indexed hybrid adjustable averaging at 2.60% (0.5 point), down from an average 2.62% from the previous week. The 1-year Treasury-indexed ARM increased a tenth of a percentage to 2.63% (0.4 point).

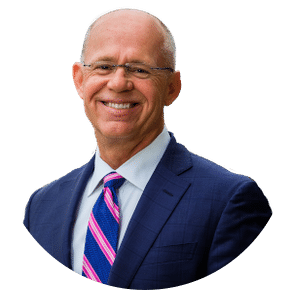

Frank Nothaft, vice president and chief economist of Freddie Mac, explained the changes and low interest rates, saying, “Mortgage rates nudged lower this week as consumer spending showed signs of weakness. Retail sales contracted for the second time in three months, falling 0.4 percent in March. In addition, the University of Michigan reported their Consumer Sentiment Index dropped 6.3 points in April to settle at 72.3, its lowest level since July. The April reading snapped a streak of three consecutive gains.”

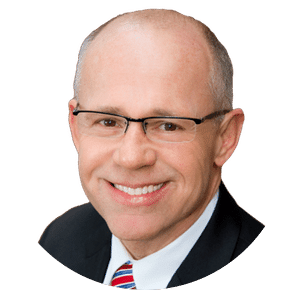

Low interest rates make it the prime time to lock in a mortgage rate and find your home. If you have been thinking about buying a home, give The Mike McCann Team a call so we can assess your needs and qualifications and help you on your journey to find that dream home as soon as possible!